Post-Merge MEV: Modelling Validator Returns

In honour of the Merge, also known as the Paris hard fork, a gigantic glass Ethereum logo has been erected in the middle of the Louvre.

In honour of the Merge, also known as the Paris hard fork, a gigantic glass Ethereum logo has been erected in the middle of the Louvre.

TL;DR

- The end of proof of work mining will result in execution layer transaction fees being paid to proof of stake validators. Due to EIP-1559 fee burn, the vast bulk of the remaining fees actually paid to validators are a consequence of “Maximal Extractable Value” (MEV).

- After the merge, Ethereum will have fixed 12-second block intervals, rather than variable block intervals with an average of 13.5 seconds. However, this will probably not make a dramatic difference to the variability of MEV.

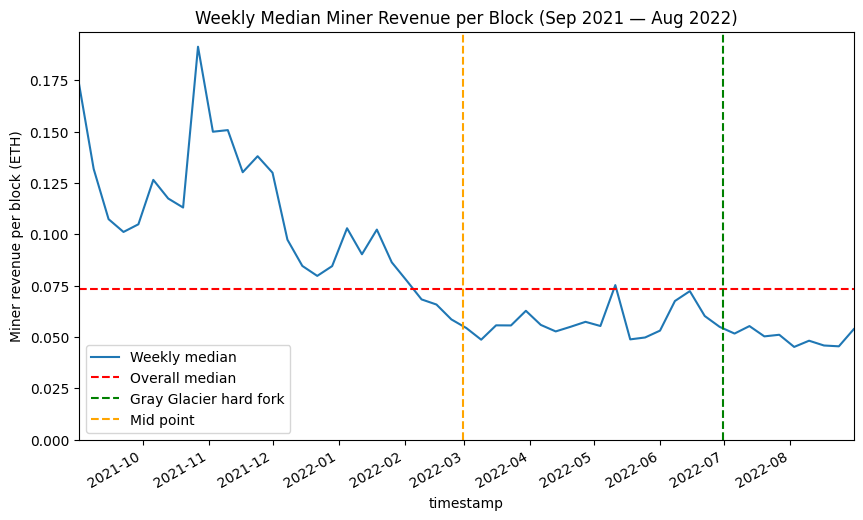

- Levels of MEV reaching miners appear to be lower since around March 2022 until August 2022, however it seems relatively consistent for the past 6 months.

- Modelling based on the same level of MEV being paid to validators post-merge indicates a median return for validators of 6.1% APR (including both MEV and consensus layer rewards), with a lower quartile of 5.3% and an upper quartile of 7.3%. This is based on the last 6 months of data (Mar 2022 — Aug 2022).

- Users running multiple validators or pooling returns with a large numbers of other validators (for example through a liquid staking provider) will experience lower variability in returns.

Introduction

As Ethereum approaches the point at which its Proof of Stake (PoS) beacon chain — launched in December 2020 — will become the consensus engine for mainnet, much online coverage has focused on the end of Proof of Work mining and concomitant reductions in both energy usage and issuance of Ether (never mind that PoS is more secure and resistant to centralisation). However another consequence of the beacon chain taking over transaction inclusion and ordering duties is that the fees currently paid to miners for transaction inclusion will instead be paid to the block proposer. That is, a validator, selected at random to propose a block every 12 seconds.

The manner in which validators are selected to propose blocks does not change from the existing process, and as I showed in my first article on validator returns, this produces some random variation in revenue, even when validators participate perfectly. So for this article, the question is how much validator returns are affected by the fees they receive for including transactions on Ethereum’s execution layer.

But What’s MEV?

In the title, I’ve referred to these execution layer fees as ‘MEV’. Perhaps this is a little confusing — the term MEV can stand for “miner extractable value” or “maximal extractable value” — neither of which seems to describe the fees received by validators for including/ordering transactions in post-merge Ethereum blocks. Validators are not miners, and in what sense might this value be ‘maximal’, anyway? The reality is that the term MEV has entered common usage to describe whatever value is — or could be — paid to the the entity responsible for transaction inclusion and ordering. To reduce the ambiguity, the Flashbots team have introduced the term “Realised Extractable Value” to describe the value actually obtained, rather than a theoretical maximum. However, even this leaves some ambiguity — are we talking about the value that is ‘realised’ by searchers, or the amount that is actually paid to miners/validators? For simplicity therefore, since ‘MEV’ is the term with widespread adoption, it is what I will use here to refer to revenue which is received by miners/validators (I know all too well how difficult it can be to change a term once it has entered widespread use).

So why use a fancy term (MEV) when we could use a straightforward one (transaction fees)? There are several reasons. Revenue from transaction inclusion and ordering has been revolutionised since Flashbots introduced a fork of the dominant Ethereum execution client, geth. As of August 2022, approximately 74% of Ethereum’s hashrate is running mev-geth, since doing so allows miners to receive bundles of transactions which exploit time-sensitive profit opportunities and are rewarded with direct payment (previously much of this revenue was wasted in a wasteful priority gas auction process — as described in Phil Daian’s original paper introducing the MEV concept). The use of the term MEV recognises this new complexity.

Furthermore, the opportunity for validators to benefit from the same revenue stream post-merge is being offered by mev-boost, developed as a collaboration between Flashbots, the Ethereum Foundation, and client teams. Indeed, whether or not validators choose to run mev-boost, the fees they receive for block proposal can still be described in a broad sense as MEV. More importantly, perhaps, since the London hard fork introduced EIP-1559, the portion of transaction fees which was in effect acting as a congestion charge is no longer paid to miners at all — it is instead burned. This means that the vast majority of miner fee revenue is now made up from those transactions which pay a special premium to miners due to the value they capture, i.e. MEV, since non-time-sensitive transactions only pay a nominal charge to the miner for inclusion.

Previous Model

In my previous articles on validator rewards, I focused solely on the rewards paid to validators for their participation in the beacon chain (i.e. consensus layer). Building on this work, in July 2021 Alex Obadia and Taarush Vemulapalli from Flashbots presented an early exploration of the impact of introducing MEV to validator rewards (see also the accompanying notebook). To do this, they looked specifically at Flashbots transaction bundles from a sample of approximately 100,000 blocks. Firstly they averaged across blocks, applying a fixed amount of MEV per block. Then they looked at the 1st and 99th centiles within that dataset to establish some bounds for the impact on validator returns (finding a very wide variation as a result of this approach).

In this article I’ll develop this approach a bit further by:

- Looking at fee revenue in its entirety (rather than only Flashbots bundles), since all miner fee revenue from the execution layer can be considered a form of MEV.

- Using a larger dataset and considering how the levels of MEV have varied over time.

- Modelling the whole distribution of outcomes.

- Calculating how these distributions change for users running multiple validators.

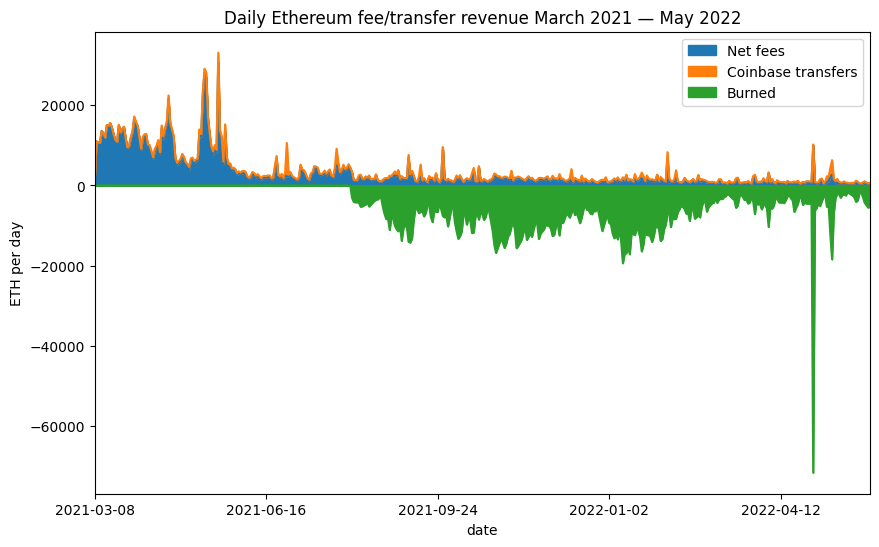

One point observed in the above article was that it was difficult to reason about the impact of EIP-1559 on the fees paid to miners (the London hard fork which introduced EIP-1559 was not live at the time the article was written). Now however we have plenty of data on this — the stacked chart below shows the portion of the fees (in green) which were previously being paid to miners, but since the London hard fork are instead subtracted from the Ether supply (burned). Clearly data from before and after the London hard fork are not comparable. For that reason, in this article we will deal only with data from the period after the London hard fork.

# imports / definitions / db connection [click to view code]

import math

from random import randrange, random, sample

from datetime import datetime, timedelta

from time import time

import psycopg2

from matplotlib import pyplot as plt

import matplotlib.dates as mdates

import pandas as pd

import numpy as np

from web3 import Web3

class Ecdf(pd.Series):

def __init__(self, data):

s = pd.Series(data)

super().__init__(s.value_counts().sort_index().cumsum()*1./len(s))

def get_quantile(self, q):

#self[self.ge(random())].index[0]

return self.index[np.argmax(self.array >= q)] # faster

def get_scaled_ecdf(self, scaling_factor):

index = [v * scaling_factor for v in self.index.values]

scaled_ecdf = self.set_axis(index)

scaled_ecdf.__class__ = Ecdf

return scaled_ecdf

start_block = 13136427 # first block of September 2021

end_block = 15449617 # last block of August 2022

SECONDS_PER_SLOT = 12

# close existing connection to mev-inspect database

try:

cursor.close()

connection.close()

except:

pass

# connect to mev-inpect database

connection = psycopg2.connect(

host="127.0.0.1",

port=5433,

user="postgres",

password="password",

database="mev_inspect"

)

connection.autocommit = True

cursor = connection.cursor()

# get block summary data from db as pandas dataframe [click to view code]

sql = (

"SELECT * FROM block_totals WHERE block_number BETWEEN %s AND %s "

"ORDER BY block_number"

)

cursor.execute(sql, (start_block, end_block))

(

block_numbers, block_timestamps, base_fees, gas_used,

net_transfers, net_fees, burned_fees, ts_diff_1, ts_diff_2

) = zip(*cursor.fetchall())

miner_extracted = [float(t + f) for t, f in zip(net_transfers, net_fees)]

# save data into a pandas dataframe

df = pd.DataFrame({

'block_number': [int(bn) for bn in block_numbers],

'timestamp': pd.to_datetime(block_timestamps),

'gas_used': [int(gu) for gu in gas_used],

'base_fee': [int(bf) for bf in base_fees],

'net_transfers': [float(nt) for nt in net_transfers],

'net_fees': [float(nf) for nf in net_fees],

'miner_extracted': miner_extracted,

'burned_fees': [float(bf) for bf in burned_fees],

'ts_diff_1': [int(ts) for ts in ts_diff_1],

'ts_diff_2': [int(ts) for ts in ts_diff_2]

})

# plot daily fees/coinbase transfers [click to view code]

daily = pd.read_csv('daily_totals.csv')

daily['net_fees'] = daily['total_fee_revenue'] - daily['total_basefee_cost']

daily['burned_ether'] = -1 * daily['total_basefee_cost']

fig, ax = plt.subplots(figsize=(10, 6))

daily.set_index('date', inplace=True)

daily.rename(inplace=True, columns={

'net_fees': 'Net fees',

'total_transfer_revenue': 'Coinbase transfers',

'burned_ether': 'Burned'

})

daily[['Net fees', 'Coinbase transfers', 'Burned']].plot.area(

ax=ax, ylabel="ETH per day"

)

ax.margins(x=0)

ax.set_title('Daily Ethereum fee/transfer revenue March 2021 — May 2022');

Selecting a Dataset

For this article, we’re going to work with historical data to try and use this to get a sense of roughly what to expect in the future (while remembering that in things financial, such an approach is not reliable). As explained in my last article, the transaction fee market changed significantly in August 2021 due to the implementation of EIP-1559 as part of the London hard fork which went live at block 12,965,000 and therefore data from before this point is not comparable with more recent data. The hard fork following this was Gray Glacier, which went live at block 15,050,000 and pushed back Ethereum’s difficulty bomb. However, average block intervals had begun to change a while before this. As we’ll see later on, changes in block interval seem to have limited impact on the MEV available, so we will not worry about the slightly increased average block interval leading up to Gray Glacier.

So we have just over a year of data available since the London hard fork. In fact we might as well take exactly a year a of data, since that allows for a period after London for the fee market to settle. So we’ll be looking at the range from block 13,136,427 (the first block mined on 1 September 2021) until block 15,449,617 (the last block mined on 31 August 2022). This gives us 1 full year of data, comprising approximately 2.3m blocks.

Having chosen this block range, we need to identify how much revenue is going to the miner of each block. For this we’ll be using Flashbots’ mev-inspect-py tool which (amongst many other features) scrapes blocks for “coinbase transfer” transactions as well as aggregating fees. This is because there are two main ways in which miners are paid for including Flashbots bundles of MEV-carrying transactions — either by setting a sufficiently high transaction fee, or including a direct payment to the miner as part of the transaction. For reasons of gas-efficiency there has been a tendency towards searchers using gas fees rather than coinbase transfers to pay miners. Still, we’d like to include both in our dataset for a more complete picture.

We have to do a little bit more work to determine the amount of MEV per block. First we have to exclude transactions that miner pay to themselves since these are not economically meaningful. This requires identifying multiple addresses controlled by a single mining pool (this involved some manual sleuthing on Etherscan) and then labelling each transaction according to whether its sender address was in a mining pool group, and labelling each block according the mining pool which produced it (see script 1). Once this was done, it was possible to produce a per-block MEV summary which subtracted the Ether burned by EIP-1559 and excluded intra-pool transfers, with the results saved as an extra table in the Postgres database populated by mev-inspect-py (see script 2).

Finally, one transaction stood out as having a much larger transaction fee than any other (7676 ETH). In fact this transaction fee on its own was worth about USD 23m, and accounted for a significant proportion of all the MEV extracted over the period. It turned out in this case the high fee was the result of a bug and in fact the vast majority of the fee was returned by the miner. With this in mind I chose to exclude this transaction from the dataset.

Block Intervals

Before we start looking in some more detail at the distribution of miner revenue across blocks, it’s worth stopping to consider the impact of one other change which accompanies the merge — namely the change from random block intervals (with an average of about 13.5 seconds between blocks) to a fixed 12-second block interval. Intuitively, we might think that longer block intervals would lead to a greater opportunities to harvest MEV from incoming transactions, and therefore more profitable blocks for miners. We also might expect the variability in block intervals to significantly affect the variability of miner revenue.

Trying to investigate these issues turned out to be something of a rabbit hole, and I concluded that definitive results were not possible using only on-chain data. However, I’ve included some notes on this in the appendix. For now, suffice it to say that, superficially, it appears as though the variable block intervals have surprisingly little impact on miner revenue. Therefore, in what follows I will make some attempt to account for the slightly increased average frequency of blocks, going from a mean interval of 13.5s to 12s, by inversely scaling all miner revenue amounts by this ratio. However, no attempt will be made in modelling to account for the change from varible to fixed block intervals.

Historical MEV levels

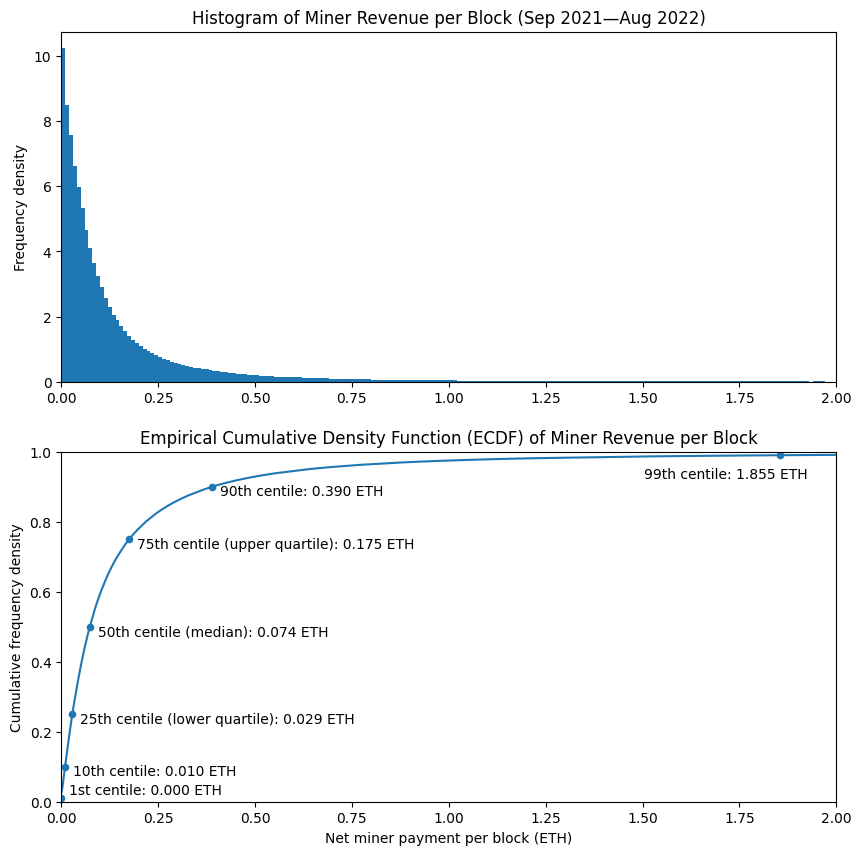

Let’s take a look at how much MEV a miner could expect to receive in a typical block. The two plots below illustrate this. The histogram (upper) shows that per-block miner revenue is most often very low — with frequencies for higher amounts of miner revenue dropping off rapidly. The second plot may be slightly less intuitive but actually tells us much more. We can see that the median miner revenue is 0.07 ETH (i.e. 50% of blocks paid their miners this amount or less, 50% paid more). A few other points have been marked on the plot, so we can see the lowest-value 1% of blocks paid nothing at all to the miner, whereas the highest-value 1% of blocks paid over 1.8 ETH to the miner. As shown in the table below (but not on the chart, since it would distort the axes too much), the top 0.1% of blocks paid 12.5 ETH or more to the miner.

# plot block revenue histogram and empirical cumulative density function (ecdf) [click to view code]

fig, (ax1, ax2) = plt.subplots(2, figsize=(10, 10))

bins = [e/100 for e in range(201)]

df['miner_extracted'].hist(ax=ax1, bins=bins, density=True, grid=False)

ax1.set_title('Histogram of Miner Revenue per Block (Sep 2021—Aug 2022)')

ax1.set_xlim(0, 2)

ax1.set_ylabel('Frequency density')

mev_ecdf = Ecdf(df['miner_extracted'])

mev_ecdf.plot(ax=ax2, label='ECDF')

quantiles = [.01, .1, .25, .5, .75, .9, .99, .999]

table = pd.DataFrame({

'quantile': quantiles,

'centile': [100 * q for q in quantiles],

'revenue<br>(ETH per block)': [mev_ecdf.get_quantile(q) for q in quantiles]

})

table.set_index('quantile', inplace=True, drop=False)

table.plot('revenue<br>(ETH per block)', 'quantile', kind='scatter', ax=ax2)

ax2.set_title(

'Empirical Cumulative Density Function (ECDF) of Miner Revenue per Block'

)

ax2.set_xlim(0,2)

ax2.set_xlabel('Net miner payment per block (ETH)')

ax2.set_ylim(0,1)

ax2.set_ylabel('Cumulative frequency density')

c1 = table['revenue<br>(ETH per block)'].loc[0.01]

ax2.annotate(f'1st centile: {c1:.3f} ETH', (c1 + 0.02, 0.02))

d1 = table['revenue<br>(ETH per block)'].loc[0.1]

ax2.annotate(f'10th centile: {d1:.3f} ETH', (d1 + 0.02, 0.075))

lq = table['revenue<br>(ETH per block)'].loc[0.25]

ax2.annotate(f'25th centile (lower quartile): {lq:.3f} ETH', (lq + 0.02, 0.225))

med = table['revenue<br>(ETH per block)'].loc[0.5]

ax2.annotate(f'50th centile (median): {med:.3f} ETH', (med + 0.02, 0.475))

uq = table['revenue<br>(ETH per block)'].loc[0.75]

ax2.annotate(f'75th centile (upper quartile): {uq:.3f} ETH', (uq + 0.02, 0.725))

d9 = table['revenue<br>(ETH per block)'].loc[0.9]

ax2.annotate(f'90th centile: {d9:.3f} ETH', (d9 + 0.02, 0.875))

c99 = table['revenue<br>(ETH per block)'].loc[0.99]

ax2.annotate(f'99th centile: {c99:.3f} ETH', (c99 - 0.35, 0.925))

plt.show()

table.rename(columns={'centile': 'centile<br>(%)'}, inplace=True)

table[

['centile<br>(%)', 'revenue<br>(ETH per block)']

].style.set_table_styles(

[dict(selector='th', props=[('text-align', 'center')])]

).hide().format(

{'centile<br>(%)': '{:.1f}', 'revenue<br>(ETH per block)': '{:.3f}'}

)

| centile (%) |

revenue (ETH per block) |

|---|---|

| 1.0 | 0.000 |

| 10.0 | 0.010 |

| 25.0 | 0.029 |

| 50.0 | 0.074 |

| 75.0 | 0.175 |

| 90.0 | 0.390 |

| 99.0 | 1.855 |

| 99.9 | 12.462 |

MEV Trends

The histogram and ECDF above are based on taking our whole year of data and treating it as though it were one static distribution. However, we might think that levels of miner revenue would vary over time, and that the distribution of miner revenue would depend on various factors like the level of on-chain activity, or by trends around the proportion of available MEV which is paid to miners, or the amount of MEV available on the base chain as compared with L2 blockchains.

To investigate this, the chart below shows the median block reward for each week of the dataset, with the overall median we saw previously indicated by the dashed red line. The reason to do this on a weekly basis is that there is some tendency for on-chain activity to follow weekly cycle, with lower activity at the weekends. So, by grouping this data and extracting the median we remove the cyclical ‘noise’. From this chart, clearly the weekly median level of miner revenue was both higher and more volatile in the earlier portion of the dataset than later on. If we divide the dataset in two (with the orange line marking the 6-month point), it seems as though we could think of the two halves of the dataset as separate, representing the levels of MEV paid to the miner under different network/market conditions. One thing that this variability should tell us however is that we cannot have a great deal of confidence in any estimates we make concerning future revenue which are based on historical data (keep this in mind, since it is exactly what I will be doing in the latter portion of this article).

# Look at variation across the dataset [click to view code]

nanoseconds_per_week = 10**9 * 60 * 60 * 24 * 7

df['week'] = (

df['timestamp'].astype(int) - df['timestamp'].astype(int).iloc[0]

) // nanoseconds_per_week

weekly_data = {

'timestamp': df.groupby(['week'])['timestamp'].first(),

'median': df.groupby(['week'])['miner_extracted'].quantile(0.5)

}

weekly = pd.DataFrame(weekly_data)

fig, ax = plt.subplots(figsize=(10, 6))

weekly.set_index('timestamp', inplace=True)

weekly['median'].plot(ax=ax, label='Weekly median')

ax.axhline(median_mev, color='r', linestyle='dashed', label='Overall median')

gg = datetime(2022, 6, 30, 10, 54, 4)

ax.axvline(gg, color='g', linestyle='dashed', label='Gray Glacier hard fork')

midpoint = df['timestamp'].iloc[len(df) // 2]

ax.axvline(midpoint, color='orange', linestyle='dashed', label='Mid point')

ax.set_title('Weekly Median Miner Revenue per Block (Sep 2021 — Aug 2022)')

ax.set_ylabel('Miner revenue per block (ETH)')

ax.set_ylim(ymin=0)

ax.set_xlim(weekly.index.min(), weekly.index.max())

ax.legend();

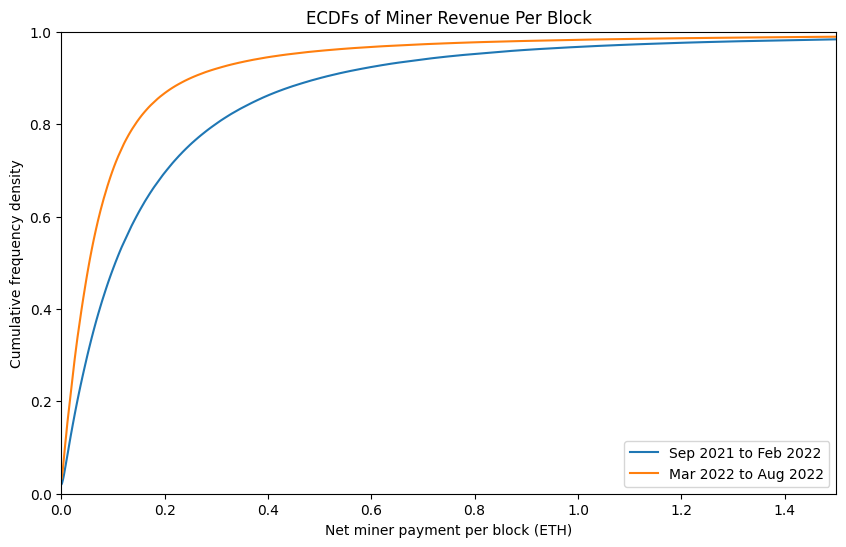

Since the levels of miner revenue across our year-long dataset are evidently not static, let’s try comparing the first half of the dataset with the second half in a more detailed way. In the plot below you can see the ECDFs for the two halves of the dataset. With the blue line (representing the first half of the dataset) below the orange line (representing the second half) and since we have revenue along the x-axis, this means that at every quantile, the levels of miner revenue were higher in the first half of the dataset. The ECDF for the whole dataset which was shown in the previous plot would fall in between these two lines. As shown in the table below, the median (50th centile) per-block MEV amount was just over half as much in the second 6-month block as it was in the first.

# Generate ECDFs for the first half of the dataset versus the second [click to view code]

mev_ecdf_h1 = Ecdf(df['miner_extracted'].iloc[:len(df) // 2])

mev_ecdf_h2 = Ecdf(df['miner_extracted'].iloc[len(df) // 2:])

fig, ax = plt.subplots(figsize=(10, 6))

mev_ecdf_h1.plot(ax=ax, label='Sep 2021 to Feb 2022')

mev_ecdf_h2.plot(ax=ax, label='Mar 2022 to Aug 2022')

ax.set_title('ECDFs of Miner Revenue Per Block')

ax.set_xlim(0,1.5)

ax.set_xlabel('Net miner payment per block (ETH)')

ax.set_ylim(0,1)

ax.set_ylabel('Cumulative frequency density')

ax.legend()

plt.show()

quantiles = [0.01, 0.1, 0.25, 0.5, 0.75, 0.9, 0.99, 0.999]

table = pd.DataFrame({

'centile': [100 * q for q in quantiles],

'h1': [mev_ecdf_h1.get_quantile(q) for q in quantiles],

'h2': [mev_ecdf_h2.get_quantile(q) for q in quantiles]

})

cols = [

('', 'centile (%)'),

('Revenue per block (ETH)', 'Sep 2021<br>to Feb 2022'),

('Revenue per block (ETH)', 'Mar 2022<br>to Aug 2022')

]

fmts = ['{:.1f}', '{:.3f}','{:.3f}']

col_formats = {c: f for c, f in zip(cols, fmts)}

table.columns = pd.MultiIndex.from_tuples(cols)

display(

table.style.set_table_styles(

[dict(selector='th', props=[('text-align', 'center')])]

).hide(axis='index').format(col_formats)

)

| ETH per block | ||

|---|---|---|

| centile | Sep 2021 to Feb 2022 |

Mar 2022 to Aug 2022 |

| 1.0% | 0.000 | 0.000 |

| 10.0% | 0.014 | 0.007 |

| 25.0% | 0.040 | 0.021 |

| 50.0% | 0.105 | 0.054 |

| 75.0% | 0.244 | 0.118 |

| 90.0% | 0.502 | 0.251 |

| 99.0% | 2.032 | 1.600 |

| 99.9% | 12.874 | 11.896 |

Simulating Post-Merge Returns from MEV

So, bringing together what we have learned about historical block revenues for miners, let’s have a go at modelling what validator returns from MEV might look like over the course of a year. Since we’re now thinking about validators instead of miners, I’ll express the results as percentage return on 32 ETH. We haven’t arrived at an analytical expression for the distribution of per-block revenues (in my time spent trying to come up with a sensible expression based on a Pareto distribution, a suitable formulation proved elusive). This slightly complicates modelling and means in this case we’re going to resort to a Monte Carlo simulation.

The basic methodology is simple — generate a random number uniformly distributed between 0 and 1, and use this number to perform a lookup from the ECDF we calculated earlier (with the ECDF scaled to account for the 13.5s to 12s change in average block intervals). Assign the block’s revenue to a randomly selected validator. Repeat until we have a year’s worth of simulated blocks (2,629,746 blocks in total). We’ll do this 3 times — using the ECDF derived from the whole year-long dataset, and then also using ECDFs from the first and second halves of the dataset.

We’re going to assume perfect validator performance (no missed block proposals). We’re also going to use a validator set size of 420,000, close to the current size of the validator set in August 2022. This number of validators also divides exactly into groups of 32, which will be useful when we look at groups of validators later on.

# simulate a year's worth of block proposals [click to view code]

# calculate average block interval

mean_interval = (df['timestamp'].max() - df['timestamp'].min()) / (len(df) - 1)

scaling_factor = SECONDS_PER_SLOT / mean_interval.total_seconds()

scaled_mev_ecdf = mev_ecdf.get_scaled_ecdf(scaling_factor)

scaled_mev_ecdf_h1 = mev_ecdf_h1.get_scaled_ecdf(scaling_factor)

scaled_mev_ecdf_h2 = mev_ecdf_h2.get_scaled_ecdf(scaling_factor)

num_validators = 420000

validators = [0] * num_validators

validators_h1 = [0] * num_validators

validators_h2 = [0] * num_validators

seconds_per_year = 31556952

slots_per_year = seconds_per_year // SECONDS_PER_SLOT

start_time = time()

last_update = 0

for slot in range(slots_per_year):

# random selection of validator as proposer

ind = randrange(num_validators)

rn = random()

# random sampling of MEV level for the block

validators[ind] += scaled_mev_ecdf.get_quantile(rn)

validators_h1[ind] += scaled_mev_ecdf_h1.get_quantile(rn)

validators_h2[ind] += scaled_mev_ecdf_h2.get_quantile(rn)

t = time()

if t - last_update > 0.1:

percentage = 100 * (slot+1) / slots_per_year

elapsed = timedelta(seconds=int(t - start_time))

print(f"{percentage:.2f}% / {elapsed} elapsed", end='\r')

last_update = t

rtn = pd.Series([100 * v / 32 for v in validators])

annual_mev_ecdf = Ecdf(rtn)

annual_mev_ecdf_h1 = Ecdf([100 * v / 32 for v in validators_h1])

annual_mev_ecdf_h2 = Ecdf([100 * v / 32 for v in validators_h2])

# plot ECDF and histogram for single validator return [click to view code]

fig, (ax1, ax2) = plt.subplots(2, figsize=(10, 10))

bins = [e/5 for e in range(151)]

rtn.hist(ax=ax1, bins=bins, density=True, grid=False)

ax1.set_title(

'Histogram of Simulated Validator Return from MEV (420k validators, 1 year)'

)

ax1.set_xlim(0, 30)

ax1.set_ylabel('Frequency density')

annual_mev_ecdf.plot(ax=ax2, label="whole dataset")

annual_mev_ecdf_h1.plot(

ax=ax2, linestyle='dashed', alpha=0.5, label="Sep 2021 to Feb 2022"

)

annual_mev_ecdf_h2.plot(

ax=ax2, linestyle='dashed', alpha=0.5, label="Mar 2022 to Aug 2022"

)

quantiles = [.01, .1, .25, .5, .75, .9, .99, .999]

table = pd.DataFrame({

'quantile': quantiles,

'centile': [100 * q for q in quantiles],

'all': [annual_mev_ecdf.get_quantile(q) for q in quantiles],

'h1': [annual_mev_ecdf_h1.get_quantile(q) for q in quantiles],

'h2': [annual_mev_ecdf_h2.get_quantile(q) for q in quantiles]

})

table.set_index('quantile', inplace=True, drop=False)

table.plot('all', 'quantile', kind='scatter', ax=ax2)

c1 = table['all'].loc[0.01]

ax2.annotate(f'1st centile: {c1:.2f}% APR', (c1 + 0.5, 0.02))

d1 = table['all'].loc[0.1]

ax2.annotate(f'10th centile: {d1:.2f}% APR', (d1 + 0.5, 0.075))

lq = table['all'].loc[0.25]

ax2.annotate(f'25th centile (lower quartile): {lq:.2f}% APR', (lq + 0.7, 0.225))

med = table['all'].loc[0.5]

ax2.annotate(f'50th centile (median): {med:.2f}% APR', (med + 1, 0.475))

uq = table['all'].loc[0.75]

ax2.annotate(f'75th centile (upper quartile): {uq:.2f}% APR', (uq + 1.3, 0.725))

d9 = table['all'].loc[0.9]

ax2.annotate(f'90th centile: {d9:.2f}% APR', (d9 + 1.8, 0.875))

c99 = table['all'].loc[0.99]

ax2.annotate(f'99th centile: {c99:.2f}% APR', (c99 - 5, 0.925))

ax2.set_title(

'ECDF for Simulated Validator Return from MEV (420k validators, 1 year)'

)

ax2.set_xlabel('Rate of return (% APR)')

ax2.set_xlim(0, 30)

ax2.set_ylabel('Cumulative frequency density')

ax2.set_ylim(0, 1)

ax2.legend(title='MEV distribution based on:', loc='lower right')

plt.show()

table.drop('quantile', axis=1, inplace=True)

cols = [

('','centile <br>(%)'),

('Rate of return (% APR)<br>based on data from:','Sep 2021<br>to Aug 2022'),

('Rate of return (% APR)<br>based on data from:','Sep 2021<br>to Feb 2022'),

('Rate of return (% APR)<br>based on data from:','Mar 2022<br>to Aug 2022'),

]

fmts = ['{:.1f}'] + ['{:.2f}'] * 3

col_formats = {c: f for c, f in zip(cols, fmts)}

table.columns = pd.MultiIndex.from_tuples(cols)

display(

table.style.set_table_styles(

[dict(selector='th', props=[('text-align', 'center')])]

).hide(axis='index').format(col_formats)

)

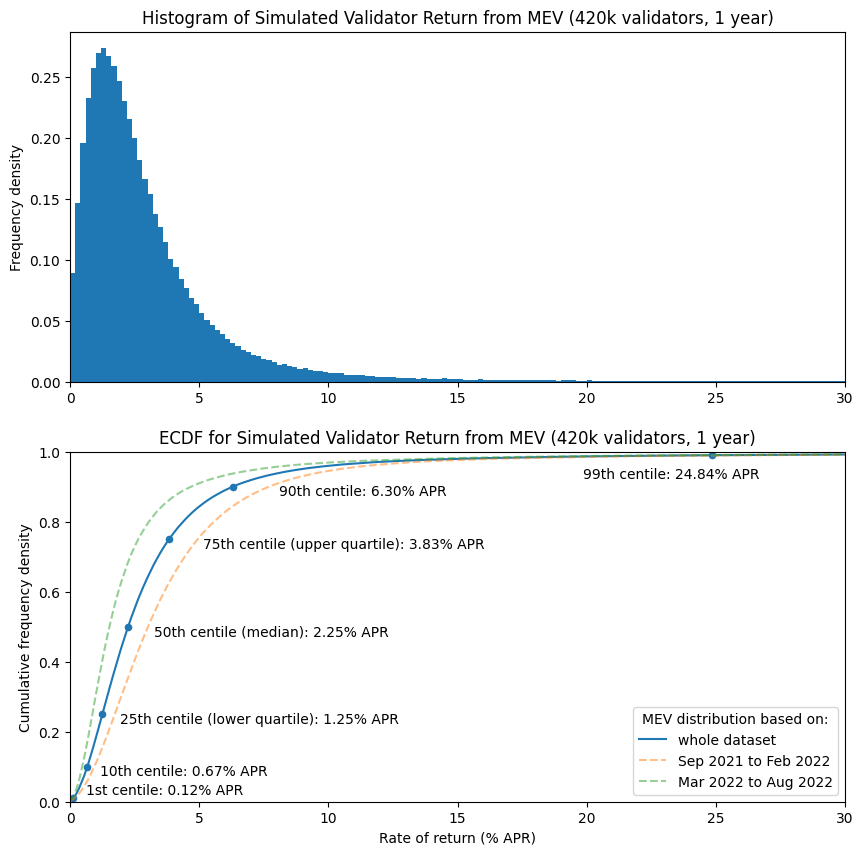

| Rate of return (% APR) based on data from: |

|||

|---|---|---|---|

| centile (%) |

Sep 2021 to Aug 2022 |

Sep 2021 to Feb 2022 |

Mar 2022 to Aug 2022 |

| 1.0 | 0.12 | 0.17 | 0.09 |

| 10.0 | 0.67 | 0.94 | 0.47 |

| 25.0 | 1.25 | 1.73 | 0.86 |

| 50.0 | 2.25 | 3.02 | 1.53 |

| 75.0 | 3.83 | 4.94 | 2.64 |

| 90.0 | 6.30 | 7.69 | 4.69 |

| 99.0 | 24.84 | 26.20 | 23.58 |

| 99.9 | 178.15 | 197.41 | 164.10 |

So, in the median case, it seems that MEV adds around 3 percentage points to the validator APR when based on data from a “high MEV” period (i.e. from Sep 2021 to Feb 2022), or about 1.5 percentage points when we use data from a “low MEV” period (Mar 2022 to Aug 2022). However, some validators receive almost nothing over the course of a year from MEV, whereas a lucky few can earn returns well in excess of 100%.

Modelling Full Validator Returns

Now we can see approximate validator returns from MEV, let’s compete the simulation by including rewards for attestation and sync committees too. Since beaconcha.in regularly indicates participation rates over 99% on the beacon chain, we’ll keep our simulation simple by assuming perfect participation. In practice, if the conditions we see on mainnet today persist after the merge, the vast majority of variability in validator rewards will come from the random assignment of proposer duties, sync committees and MEV, rather than being due to validator performance.

Therefore in the simulation below, all validators given an identical reward for perfect attestation performance, but a committee of 512 validators is selected at random every 256 epochs, and that committee then earns a full sync committee reward, for perfect participation over the subsequent 256 epochs. MEV per block is selected in the same way as before, but now validators receive beacon chain proposer rewards, as well as execution layer transaction fees (MEV).

# model full validator returns using previously calculated MEV ECDFs [click to view code]

num_validators = 420000

HEAD_WT = 14

SOURCE_WT = 14

TARGET_WT = 26

SYNC_WT = 2

PROPOSER_WT = 8

BASE_REWARD_FACTOR = 64

WEIGHT_DENOM = 64

EPOCHS_PER_COMMITTEE = 256

COMMITTEE_SIZE = 512

SLOTS_PER_EPOCH = 32

GWEI_PER_ETH = int(1e9)

gwei_per_validator = int(32e9)

staked_gwei = gwei_per_validator * num_validators

epochs_per_year = slots_per_year // SLOTS_PER_EPOCH

base_reward = gwei_per_validator * BASE_REWARD_FACTOR // math.isqrt(staked_gwei)

total_reward = base_reward * num_validators

att_reward = base_reward * (HEAD_WT + SOURCE_WT + TARGET_WT) // WEIGHT_DENOM

annual_attestation_reward_eth = att_reward * epochs_per_year / GWEI_PER_ETH

# perfect performance so all validators get full attestation reward for the year

validators = [annual_attestation_reward_eth] * num_validators

validators_h1 = [annual_attestation_reward_eth] * num_validators

validators_h2 = [annual_attestation_reward_eth] * num_validators

prop_reward = total_reward * PROPOSER_WT // WEIGHT_DENOM // SLOTS_PER_EPOCH

prop_reward_eth = prop_reward / GWEI_PER_ETH

sync_reward = total_reward * SYNC_WT // WEIGHT_DENOM // SLOTS_PER_EPOCH \

// COMMITTEE_SIZE

sync_reward_eth = sync_reward / GWEI_PER_ETH

start_time = time()

last_update = 0

for slot in range(slots_per_year):

# process sync committee:

if slot % (32 * EPOCHS_PER_COMMITTEE) == 0:

# select sync committee

committee = sample(range(num_validators), COMMITTEE_SIZE)

for ind in committee:

validators[ind] += sync_reward_eth

validators_h1[ind] += sync_reward_eth

validators_h2[ind] += sync_reward_eth

# random selection of validator as proposer

ind = randrange(num_validators)

r = random()

validators[ind] += scaled_mev_ecdf.get_quantile(r) + prop_reward_eth

validators_h1[ind] += scaled_mev_ecdf_h1.get_quantile(r) + prop_reward_eth

validators_h2[ind] += scaled_mev_ecdf_h2.get_quantile(r) + prop_reward_eth

t = time()

if t - last_update > 0.1:

percentage = 100 * (slot+1) / slots_per_year

elapsed = timedelta(seconds=int(t - start_time))

print(f"{percentage:.2f}% / {elapsed} elapsed", end='\r')

last_update = t

annual_full_rtn = pd.Series([100 * v / 32 for v in validators])

annual_full_ecdf = Ecdf(annual_full_rtn)

annual_full_ecdf_h1 = Ecdf([100 * v / 32 for v in validators_h1])

annual_full_ecdf_h2 = Ecdf([100 * v / 32 for v in validators_h2])

# plot simulated full validator returns [click to view code]

fig, (ax1, ax2) = plt.subplots(2, figsize=(10, 10))

bins = [e/5 for e in range(176)]

annual_full_rtn.hist(ax=ax1, bins=bins, density=True, grid=False)

ax1.set_title(

'Histogram of Simulated Validator Rate of Return (420k validators, 1 year)'

)

ax1.set_xlim(0, 35)

ax1.set_ylabel('Frequency density')

quantiles = [0, .01, .1, .25, .5, .75, .9, .99, .999, 1]

table = pd.DataFrame({

'quantile': quantiles,

'centile': [100 * q for q in quantiles],

'all': [annual_full_ecdf.get_quantile(q) for q in quantiles],

'h1': [annual_full_ecdf_h1.get_quantile(q) for q in quantiles],

'h2': [annual_full_ecdf_h2.get_quantile(q) for q in quantiles ]

})

table.set_index('quantile', inplace=True, drop=False)

table.plot('all', 'quantile', kind='scatter', ax=ax2)

annual_full_ecdf.plot(ax=ax2, label="whole dataset")

annual_full_ecdf_h1.plot(

ax=ax2, linestyle='dashed', alpha=0.5, label="Sep 2021 to Feb 2022"

)

annual_full_ecdf_h2.plot(

ax=ax2, linestyle='dashed', alpha=0.5, label="Mar 2022 to Aug 2022"

)

c1 = table['all'].loc[0.01]

ax2.annotate(f'1st centile: {c1:.2f}% APR', (c1 + 0.7, 0.02))

d1 = table['all'].loc[0.1]

ax2.annotate(f'10th centile: {d1:.2f}% APR', (d1 + 0.7, 0.075))

lq = table['all'].loc[0.25]

ax2.annotate(f'25th centile (lower quartile): {lq:.2f}% APR', (lq + 1, 0.225))

med = table['all'].loc[0.5]

ax2.annotate(f'50th centile (median): {med:.2f}% APR', (med + 1, 0.475))

uq = table['all'].loc[0.75]

ax2.annotate(f'75th centile (upper quartile): {uq:.2f}% APR', (uq + 1.3, 0.725))

d9 = table['all'].loc[0.9]

ax2.annotate(f'90th centile: {d9:.2f}% APR', (d9 + 1.8, 0.875))

c99 = table['all'].loc[0.99]

ax2.annotate(f'99th centile: {c99:.2f}% APR', (c99 - 6, 0.925))

ax2.set_title('Simulated Validator Rate of Return (420k validators, 1 year)')

ax2.set_xlabel('Rate of return (% APR)')

ax2.set_xlim(0, 35)

ax2.set_ylabel('Cumulative frequency density')

ax2.set_ylim(0, 1)

ax2.legend(title='MEV distribution based on:', loc='lower right')

plt.show()

table.drop('quantile', axis=1, inplace=True)

cols = [

('','centile<br>(%)'),

('Rate of return (% APR)<br>based on data from:','Sep 2021<br>to Aug 2022'),

('Rate of return (% APR)<br>based on data from:','Sep 2021<br>to Feb 2022'),

('Rate of return (% APR)<br>based on data from:','Mar 2022<br>to Aug 2022'),

]

fmts = ['{:.1f}'] + ['{:.2f}'] * 3

col_formats = {c: f for c, f in zip(cols, fmts)}

table.columns = pd.MultiIndex.from_tuples(cols)

display(

table.style.set_table_styles(

[dict(selector='th', props=[('text-align', 'center')])]

).hide(axis='index').format(col_formats)

)

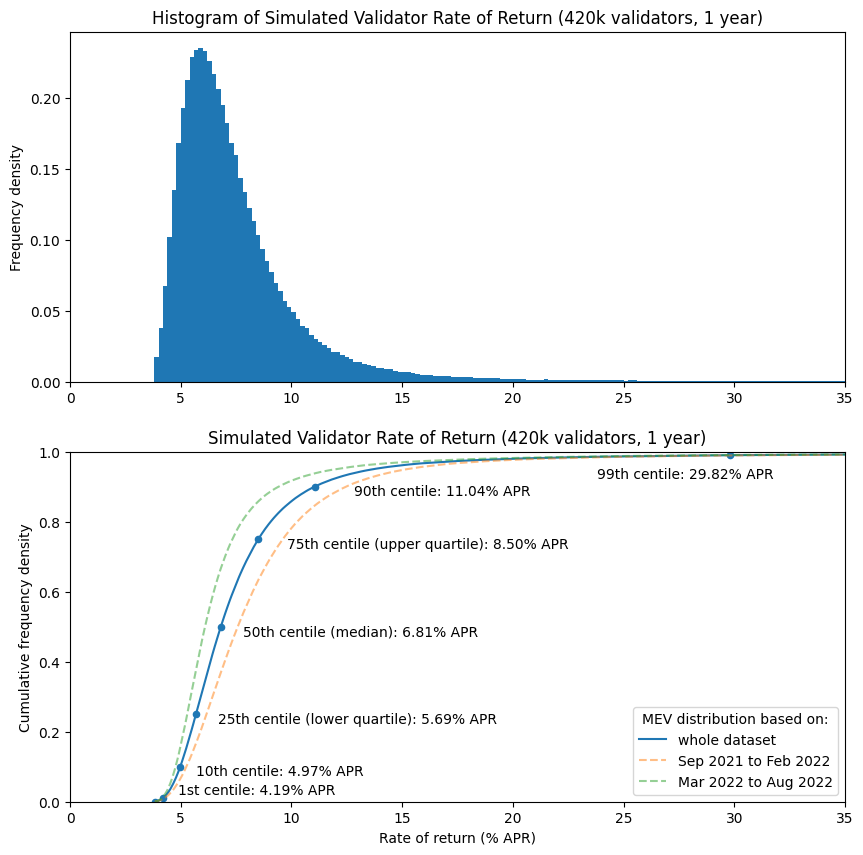

| Rate of return (% APR) based on data from: |

|||

|---|---|---|---|

| centile (%) |

Sep 2021 to Aug 2022 |

Sep 2021 to Feb 2022 |

Mar 2021 to Aug 2022 |

| 0.0 | 3.83 | 3.83 | 3.83 |

| 1.0 | 4.19 | 4.26 | 4.14 |

| 10.0 | 4.97 | 5.25 | 4.77 |

| 25.0 | 5.69 | 6.16 | 5.29 |

| 50.0 | 6.81 | 7.57 | 6.10 |

| 75.0 | 8.50 | 9.61 | 7.33 |

| 90.0 | 11.04 | 12.46 | 9.41 |

| 99.0 | 29.82 | 31.28 | 28.44 |

| 99.9 | 197.77 | 220.02 | 177.84 |

| 100.0 | 4551.45 | 2019.30 | 4549.61 |

So, based on our full year historical MEV dataset, scaled to account for decreased mean block interval, we arrive at a simulated rate of return between around 5.7% and 8.5% for the “middle 50%” of validators. Meanwhile the “luckiest 1%” receive 30% APR, and the “unluckiest 1%” only 4.2%. The least profitable validator in the whole set still made a return of 3.8%, whilst the most profitable managed over 4500% (i.e. 45x) for the year. Bear in mind that the rates of return in this model are not compounded — in practice, operators earning such large returns may will choose to spin up new validators and therefore will begin earning a return on those too.

Running Multiple Validators

The final question we’re going to consider is what happens to the distribution of returns for stakers who are running multiple validators. In the plot and table below, the validators from our simulated set (based on the full year of block revenue data) have been grouped into sets of 2, 4, 8, 16 and 32 validators, so we can compare the % APR ECDFs for the different group sizes. Also shown (red dashed line) is the mean return from the whole validator set (i.e. the return each validator would earn if all MEV and beacon chain rewards were shared equally). The mean return is what we would expect very large validator groups (e.g. Lido, or very large institutional stakers) to earn before any fees they subtract.

# calculate ECDFs for 1, 2, 4, 8, 16, 32 validators [click to view code]

rtns = []

ecdfs = []

for e in range(6):

ecdfs.append(Ecdf([

100 * sum(validators[i:i+2**e]) / (32 * 2**e)

for i in range(0, num_validators, 2**e)

]))

mean_return = 100 * sum(validators) / (32 * len(validators))

fig, ax = plt.subplots(figsize=(10, 6))

for e in range(6):

label = '1 validator' if e == 0 else f'{2**e} validators'

ecdfs[e].plot(ax=ax, label=label)

ax.set_xlim(3, 15)

ax.set_ylim(0, 1)

ax.set_title("ECDF for Validator Returns (1 year, 420k validators)")

ax.set_xlabel("Rate of return (% APR)")

ax.set_ylabel("Cumulative frequency density")

ax.axvline(mean_return, color='r', linestyle='dashed', label='Mean return')

ax.legend();

plt.show()

quantiles = [0.01, 0.1, 0.25, 0.5, 0.75, 0.9, 0.99, 0.999]

table = pd.DataFrame({'quantile': [100 * q for q in quantiles]})

for e in range(6):

table[2**e] = [ecdfs[e].get_quantile(q) for q in quantiles]

cols = [('','centile<br>(%)')] + [

('Rate of return (% APR) for number of validators:', 2**e) for e in range(6)

]

fmts = ['{:.1f}'] + ['{:.2f}'] * 6

col_formats = {c: f for c, f in zip(cols, fmts)}

table.columns = pd.MultiIndex.from_tuples(cols)

display(

table.style.set_table_styles(

[dict(selector='th', props=[('text-align', 'center')])]

).hide(axis='index').format(col_formats)

)

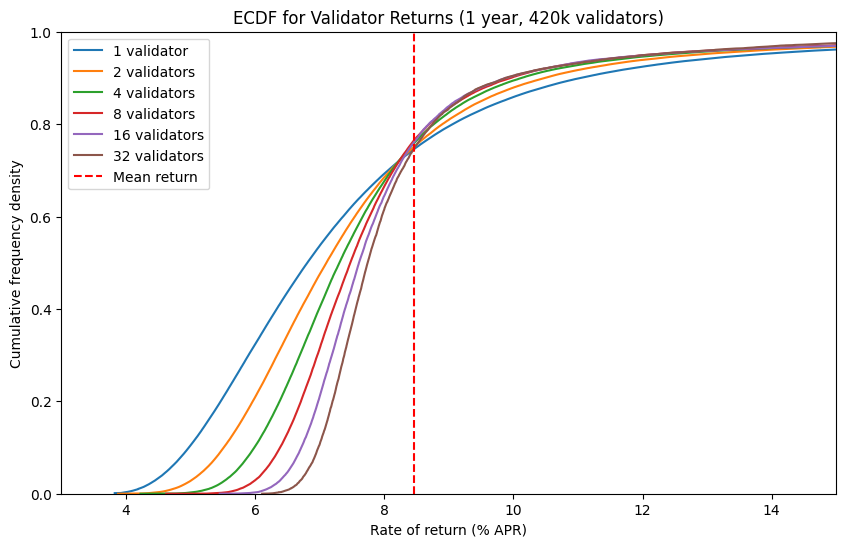

| Rate of return (% APR) for number of validators: | ||||||

|---|---|---|---|---|---|---|

| centile (%) |

1 | 2 | 4 | 8 | 16 | 32 |

| 1.0 | 4.19 | 4.72 | 5.27 | 5.76 | 6.18 | 6.54 |

| 10.0 | 4.97 | 5.52 | 5.99 | 6.39 | 6.72 | 6.98 |

| 25.0 | 5.69 | 6.16 | 6.54 | 6.84 | 7.08 | 7.30 |

| 50.0 | 6.81 | 7.11 | 7.31 | 7.48 | 7.61 | 7.74 |

| 75.0 | 8.50 | 8.46 | 8.40 | 8.38 | 8.41 | 8.47 |

| 90.0 | 11.04 | 10.49 | 10.13 | 9.96 | 9.89 | 9.88 |

| 99.0 | 29.82 | 29.35 | 29.01 | 28.67 | 23.55 | 20.81 |

| 99.9 | 197.77 | 151.36 | 133.60 | 89.13 | 70.29 | 55.00 |

Looking at the ECDFs and table above, we can see that as more validators are grouped together, the ECDF lines get steeper and steeper. This is equivalent to the peak of a histogram getting narrower, and shows how the variablity of rewards decreases as the size of the validator group grows. The effect can also be observed by looking at the numbers in the table above — for example while the interquartile range for running a single validator (i.e. the difference in % APR between the 25th and 75th centiles) is about 2.8 percentage points, for a group of 32 validators, the interquartile range is only 1.2 percentage points.

This is what we would expect — by running multiple validators, we can smooth out the variability in rewards from both the consensus and execution layers. From my own perspective, I’m slighly surprised that the variability (as measured by interquartile range) of returns from a group of 32 validators is only around 2.3 times lower than than the variability of returns a singe validator. This is encouraging, since some users will be attracted by the ability to smooth out returns and make them more predictable, which would result in a tendency towards centralisation (for context, if rewards were Normally disributed, an increase in stake by 32x would result in a reduciton in reward variability of $\sqrt{32}\approx5.8$ times). Barnabé Monnot (who leads the Ethereum Foundation’s Robust Incentives Group) has done some initial work looking at the tendency towards wealth centralisation which could be the result of uneven reward distribution, but this remains very much an open research question.

Conclusions

In this article, we have attempted to use past data to model the impact of post-merge execution layer fees on validator returns. We found that when we used data from a period when MEV was abundant (Sep 2021 to Feb 2022), MEV added about 3 percentage points to validator returns, but this dropped to 1.5 percentage points when using data from a period when MEV was more scarce (Mar 2022 to Aug 2022). In either case, the level of reward was highly variable, with some valdiators receiving practically no MEV over the course of a year, while some made well over 100% APR return. When we added in consensus layer rewards, we found that perfectly performing validators would receive a minimum of 3.8% APR, with median returns ranging from 6.1% APR (based on the low MEV dataset) up to 7.6% APR (high MEV dataset). We found that groups of validators would receive smoother rewards than solo validators, although (to me at least) this effect was less pronounced than expected, with the variability of returns for a group of 32 validators being around 2.3 times lower than variability for a solo validator.

However, as always, past performance provides no guarantee of future returns. Many unanswered questions remain about the extent to which MEV will be available to validators in future, versus for example how much ends up being captured by other actors (applications, users, L2 sequencers, builders, relays…). As a result, the results of the modelling in this article should not be treated as a prediction for the future, but rather as a look at a couple of plausible scenarios.

Finally, I haven’t dealt with the fact that after the merge, the identity of the proposer for a given slot is known in advance. This feature of current proof of stake blockchains allows new possibilities for atomic cross-chain transactions (since validators with a significant proportion of stake may be able to guarantee coincident block proposals on multiple blockchains), as well as multi-block MEV. How these effects will play out remains a big unknown. Nonetheless, hopefully this article can offer some indication of what validators can expect as Ethereum heads towards the merge, and ways of thinking about validator returns which may help make sense of the emerging proof of stake landscape in the coming weeks, months and years.

Open Questions

The modelling carried out for this article rests on assumptions about how the Ethereum blockspace market will behave after the transition to proof of stake. With the merge occuring in only a few days, it will soon be possible to test these assumptions by collecting data on post-merge execution layer fees. It would be interesting to know:

- How much has block proposal revenue variability been impacted by the change to fixed slot intervals?

- What is the difference in block proposal revenue for validators running mev-boost as compared with those who build their own blocks?

There are many open questions on the impact of the proof of stake transition will have on MEV also. For example:

- How much more revenue can large stakers extract by being nominated as proposers for consecutive slots?

- Some validators may also participate in consensus for other proof of stake blockchains, creating the posibility for coincident block propoposals on multiple chains and therefore atomic cross-chain MEV extraction. How valuable is this?

- For both the above points, how strong is the tendency to centralisation of stake, given the economy of scale for multi-block and atomic cross-chain opportunities?

Of course, many open questions remain in the wider universe of MEV research also, such as:

- How efficient is the blockspace market? If searchers compete effectively then the vast majority MEV should be paid back to validators. However if competition is less strong (either due to a small number of effective participants, or collusion between them) then MEV may be more effectively captured by searchers.

- What proportion of the negative impacts of MEV on users can be mitigated through improved application or protocol design (e.g. the use of techniques such as threshold encryption)?

Acknowledgements

Many thanks to the Flashbots team, who provided a grant for this work, and for guidance and support getting to grips with MEV, particularly the use of mev-inspect-py. Thanks to Alex Obadia, Elaine Hu and Gui Heise for thoughts and feedback as I wrote this up. Thanks also to Barnabé Monnot (Ethereum Foundation) and Vasiliy Shapovalov (Lido) for thoughtful feedback.

Photo by Patrick Langwallner on Unsplash.

Appendix: Block Intervals

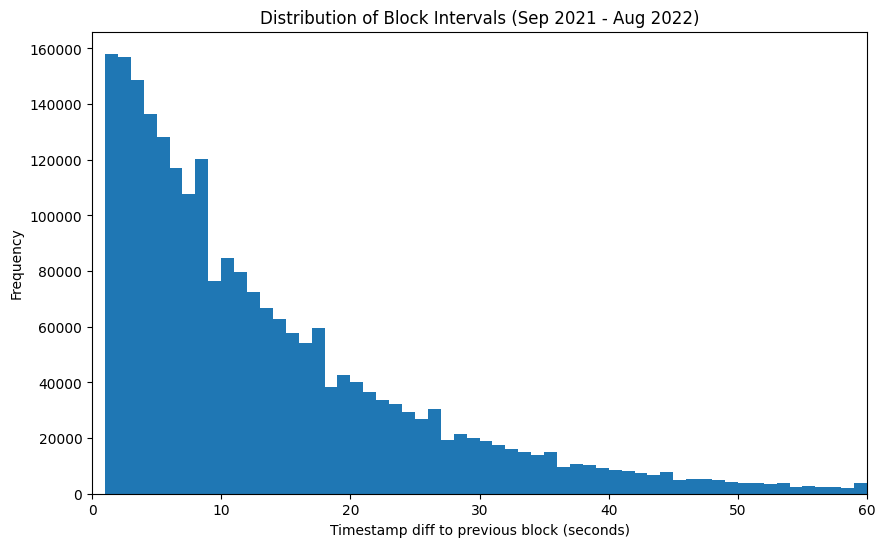

After the merge, rather than having variable block intervals with an average of about 13.5s, we will have a fixed block interval of 12s. The obvious consequence of this is that post-merge Ethereum will have slightly higher throughput by virtue of having slightly more frequent blocks. However, the subtler consequence is that the variability of block intervals will decrease dramatically. In pre-merge (i.e. proof of work) Ethereum, the amount of time between blocks successive blocks approximates an exponential distribution. This is because Ethereum block production is well-modelled as a Poisson process — that is, the probability of finding the next block within time $\delta$ remains constant. Take a look at the histogram of block intervals below, which is based on the timestamps which miners attach to their blocks.

# plot block interval histogram [click to view code]

fig, ax = plt.subplots(figsize=(10, 6))

df['ts_diff_1'].plot.hist(bins=[b for b in range(61)], ax=ax)

ax.set_xlabel('Timestamp diff to previous block (seconds)')

ax.set_ylabel('Frequency')

ax.set_title('Distribution of Block Intervals (Sep 2021 - Aug 2022)')

ax.set_xlim(xmin=0, xmax=60);

This chart shows that in broad outline the block interval on pre-merge Ethereum does follow the the shape of an exponential distribution. It’s not perfect — timestamp resolution is only down to 1s, and no two blocks in the canonical chain can have the same timestamp (hence no bar at 0s).

The slightly more confusing effect is the surplus of blocks that show up in every 9th second of the distribution. I’m not the only person to have spotted this effect, which is the result of miners’ ability to set the timestamp on blocks they produce. It turns out that some miners appear to have abused this power to slightly reduce their risk of mining an uncle block and hence increase their profitability:

Do miners execute consensus-level attack against Ethereum (or other major tokens)❓🤔

— Aviv Yaish (@yaish_aviv) August 5, 2022

The answer is *yes*❗🤯

Read on for full deets 👇

Joint work with Gilad Stern and @Avivz78.

Full paper: https://t.co/PffJRQ3X3W

Medium post: https://t.co/qMOsRrN5DJ

... (1/12)

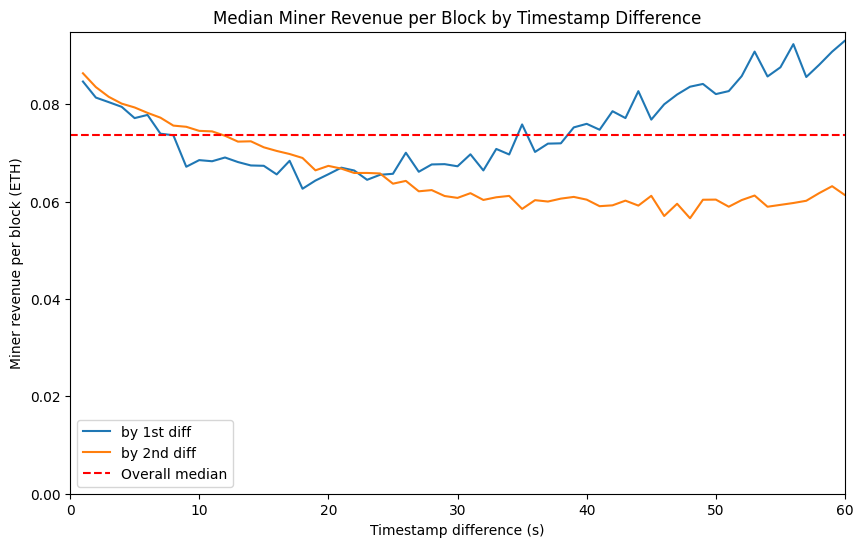

Regardless of whether miners sometimes manipulate block timestamps, as is clear from the distribution above, blocks are very frequently mined in quick succession. There are also sometimes very long intervals between successive blocks — a minute or more. Intuitively, we might think that a longer block interval means more time to collect more fees, and therefore greater miner revenue. To investigate this I looked at the median miner revenue, plotted below, where the median is taken from blocks grouped by the timestamp difference from block $n$ to block $n-1$ (blue line), and then by the time difference between blocks $n-1$ and $n-2$ (orange line).

# plot median fees by block interval [click to view code]

diff1_med = df.groupby('ts_diff_1')['miner_extracted'].median()

diff2_med = df.groupby('ts_diff_2')['miner_extracted'].median()

fig, ax = plt.subplots(figsize=(10, 6))

diff1_med[:61].plot(ax=ax, label='by 1st diff')

diff2_med[:61].plot(ax=ax, label='by 2nd diff')

median_mev = df['miner_extracted'].median()

ax.axhline(median_mev, color='r', linestyle='dashed', label='Overall median')

ax.set_ylim(ymin=0)

ax.set_xlim(xmin=0, xmax=60)

ax.set_title('Median Miner Revenue per Block by Timestamp Difference')

ax.set_xlabel('Timestamp difference (s)')

ax.set_ylabel('Miner revenue per block (ETH)')

ax.legend();

What we observe is confusing. Based on the first timestamp difference, rewards seem to drop off initially and then build up for longer block intervals. When we look at the second timestamp difference, MEV rates seem only to reduce further and further, the longer the block interval. I have theories about why these patterns might be. But I will move on rather than present them here because (a) I’m not confident about them and (b) this problem is no longer relevant post-merge, once block times are fixed.

What I will conclude from this digression is that the block interval does not seem to have a dramatic impact on miner revenue — the median by block interval remains within about 20% of the overall median. Therefore for the remainder of this article, I will treat post-merge miner revenue as being broadly equivalent to pre-merge miner revenue, and will not make allowances for the change from a variable to fixed block interval. We might reasonably expect that variability of miner revenue will decrease somewhat as a result of the reduced variability in block interval, but the effect will not be large.